Introduction:

In the world of precious metals, gold has long been regarded as a symbol of wealth and a safe-haven asset for investors. Among the various forms in which gold is traded, the 500-gram gold bar stands out as a popular choice for those seeking a tangible and valuable investment. In this article, we will explore the allure of the 500-gram gold bar as an investment option, examining its characteristics, advantages, and the factors to consider when incorporating it into your portfolio.

The Appeal of 500 Gram Gold Bars:

Tangible Wealth: The 500-gram gold bar represents a significant quantity of pure gold, providing investors with a tangible and substantial asset. Holding a physical gold bar adds a sense of security and permanence to one's investment portfolio.

Liquidity and Flexibility: Despite its weight, the 500-gram gold bar remains relatively manageable and liquid. This makes it a practical choice for investors who value flexibility and the ability to easily buy or sell their gold holdings in the market.

Diversification: Incorporating 500-gram gold bars into a diversified investment portfolio is a strategic move. Gold has historically demonstrated a low correlation with other asset classes, such as stocks and bonds, making it an effective means of diversification and risk mitigation.

Global Recognition: Gold is universally recognized and accepted as a store of value. The 500-gram gold bar, like other gold denominations, holds its value across borders and cultures, making it an attractive option for international investors seeking stability in times of economic uncertainty.

Storage and Security: While storing large quantities of gold may pose challenges, a 500-gram gold bar strikes a balance between value and ease of storage. Investors can choose secure storage options, such as bank vaults or reputable private facilities, to ensure the safety of their precious metal investments.

Factors to Consider:

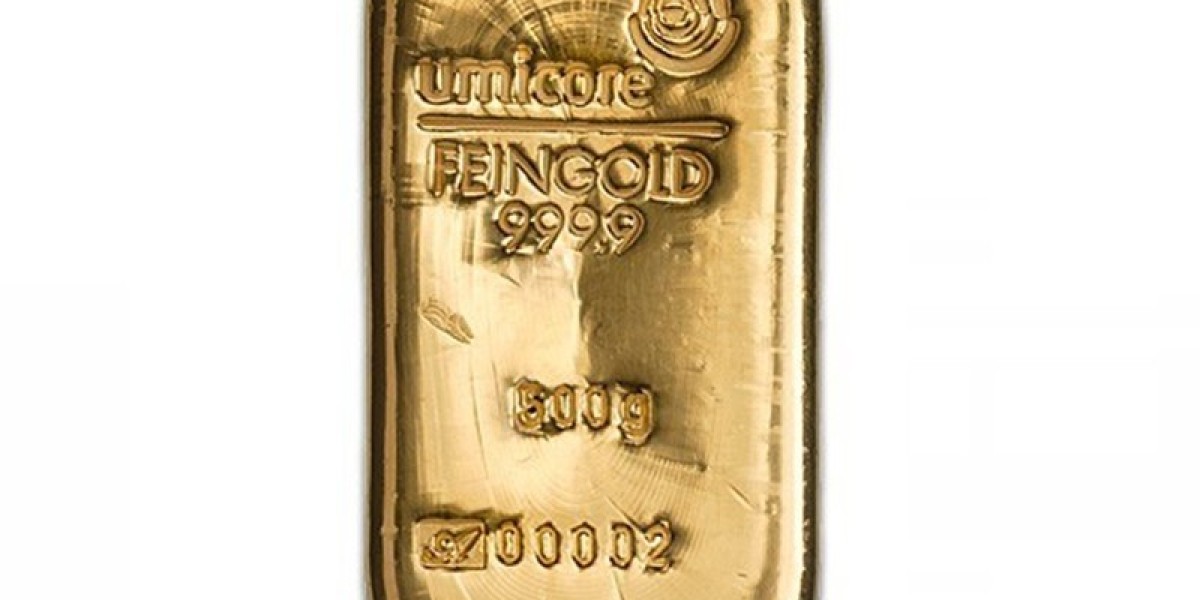

Purity and Authentication: Before investing in a 500-gram gold bar, ensure that it meets industry standards for purity. Authentication and verification from reputable sources are crucial to guarantee the gold's authenticity and value.

Market Conditions: Like any investment, the value of gold is influenced by market conditions. Stay informed about economic trends, geopolitical events, and inflation rates, as these factors can impact the price of gold.

Transaction Costs: Consider transaction costs associated with buying or selling gold bars. These costs may include premiums, taxes, and shipping fees. Understanding these expenses is essential for making informed investment decisions.

Conclusion:

The 500-gram gold bar holds a unique position in the world of precious metal investments, offering investors a balance between substantial value and practicality. As part of a diversified portfolio, gold bars can provide stability and act as a hedge against economic uncertainties. However, it's crucial for investors to conduct thorough research, verify the authenticity of their gold bars, and stay informed about market conditions to make well-informed decisions in their pursuit of long-term financial security.

Visit Us: https://www.a1mint.com/